Considering taking right out an interest rate? Here you will find the newest mortgage prices additionally the best things one to influence them.

Financial costs fluctuate daily considering fiscal conditions. Listed here are today’s financial cost and all you have to discover in the obtaining best rates. ( iStock )

The fresh new average interest rate toward a thirty-season repaired-price home loan is 6.375% since August 14, that’s 0.115 fee things below last night. Concurrently, the fresh average interest into good fifteen-season repaired-rates home loan is 5.625%, that’s undamaged off past.

Analysts are hopeful that lower interest rates are on the horizon. The Federal Reserve has indicated that a cut right out might be sensed during the Sep.

With financial costs modifying everyday, it’s a good idea to evaluate the current rate before applying for that loan. You will want to contrast different lenders’ most recent rates of interest, terms and conditions and charge to be sure you earn a knowledgeable bargain.

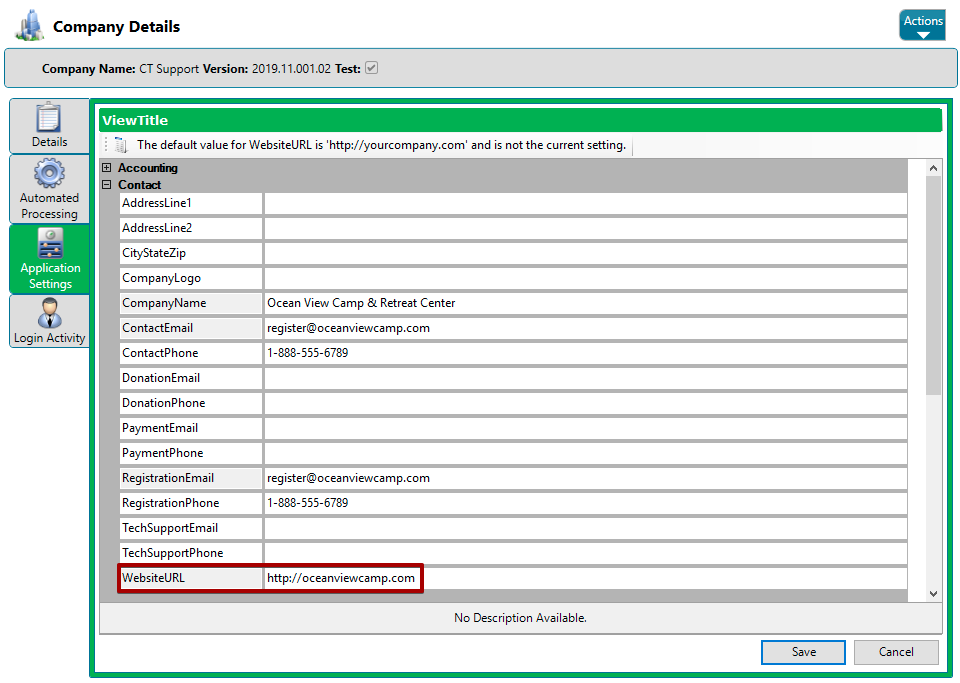

Median rates history updated . Rates are determined centered on study out of more than 500 mortgage brokers in every fifty states. Credible accumulates the information and knowledge each day utilising the following the information: $eight hundred,000 price, $80,000 down-payment, single-nearest and dearest number one cash advance Haleburg Alabama house, and an excellent 740+ FICO rating.

- How do mortgage rates works?

- Exactly what establishes the mortgage speed?

- How-to contrast financial cost

- Positives and negatives away from mortgages

- How to be eligible for a home loan

- How exactly to sign up for a mortgage

- Tips re-finance a mortgage

- How to supply your own residence’s security

- FAQ

How can home loan rates work?

When you take aside a mortgage loan purchasing a house, you might be borrowing funds from a lender. So as that you to definitely bank while making a profit and relieve exposure in order to in itself, it can fees appeal with the prominent – that’s, extent you owe.

Expressed as a percentage, a mortgage interest rate is essentially the cost of borrowing money. It can vary based on several factors, such as your credit rating, debt-to-money proportion (DTI), down payment, loan amount and repayment term.

After getting a mortgage, you’ll typically receive an amortization schedule, which shows your payment schedule over the life of the loan. It also indicates how much of each payment goes toward the principal balance versus the interest.

Nearby the beginning of the loan name, it is possible to save money money on desire much less on prominent harmony. Since you strategy the termination of the installment identity, you are able to pay way more to your the principal much less toward attention.

Your mortgage rate of interest is going to be often repaired otherwise varying. Which have a predetermined-rate home loan, the pace could well be uniform throughout the borrowed funds. Having a varying-rates home loan (ARM), the rate can be change into markets.

Just remember that , an excellent mortgage’s interest is not the just like their annual percentage rate (APR). The reason being an annual percentage rate boasts both the interest rate and you can all other lender costs or costs.

Financial prices change appear to – either on a daily basis. Rising cost of living takes on a life threatening role throughout these movement. Interest levels tend to boost in periods away from higher rising prices, whereas they have a tendency to decrease or remain about a comparable within the days of reasonable rising prices. Other factors, such as the economic climate, request and you will collection may affect the most recent average home loan cost.

To find great mortgage rates, start by using Credible’s secured website, which can show you current mortgage rates from multiple lenders without affecting your credit score. You can also use Credible’s financial calculator to estimate your monthly mortgage payments.

What find the loan speed?

Mortgage lenders generally speaking dictate the interest rate to the a situation-by-circumstances base. Basically, it reserve a low costs getting lowest-exposure consumers – that’s, people with a high credit rating, money and deposit count. Here are some almost every other private issues that influence their mortgage rate: