This post is considering look of the copywriter, who’s not a monetary, tax, otherwise lawyer. This post will not mirror the newest viewpoints away from Lennar Corporation or the associates. This is simply not meant to provide any economic or legal services, and you should speak to your individual monetary or courtroom advisor, mortgage elite or borrowing pro to find out more throughout the credit scores and fund essentially otherwise your credit rating especially.

The reduced your credit score, the more interest might pay along the life of brand new financing

This will depend on which you mean by finest. The greatest score you are able to are 850, but one to count is virtually impossible to get to. Impossible becomes unnecessary. A lender is not going to require a score out-of 850 for each financing certification.

Scrape the definition of perfect. The thought of perfect is actually alone a misconception. Query instead: manage I would like a leading credit score to find a house? The answer is no. Following, why does a lender care about it count? Your credit rating states a lot concerning your credibility while the a great borrower, and it may dictate popular features of the loan, together with your down-payment and you may rate of interest. A conclusion of them factors comes after within the next point. But not, the lowest credit score does not necessarily mean you simply cannot be considered for a financial loan, and we will evaluate those loan models that assistance which.

Of the meaning, your credit rating are good around three-digit number, between three hundred to help you 850, that appraises the creditworthiness. It informs a loan provider whenever you are reliable to repay a Avon loans locations good loan, centered on your credit history. Your credit history comes with your commission record, credit use, borrowing from the bank decades, (recent) credit inquiries, and you can derogatory marks. Additionally reveals the number (and you may types) from discover (and closed) borrowing from the bank levels you own. Borrowing profile might be playing cards, figuratively speaking, automobile financing, lenders, or other fund.

Fico scores try chance symptoms. To help you a loan provider, a top rating means a lesser exposure. Less chance of what? Of you (the latest debtor) defaulting into financing. So you’re able to default form you fail to afford the monthly mortgage payment and you will get behind. A lower life expectancy score means increased exposure. The financial institution may still accept the loan, regardless of if your own score can be as lowest as five hundred, but you’ll find likely criteria in order to counterbalance the exposure. The very first is you create a bigger deposit. A larger down payment mode your borrow less overall. It lowers the borrowed funds-to-really worth proportion (i.age., the proportion out-of financing on property value a home) and you will suggests exactly how polite you are about this financial support. The second status try a higher interest rate.

Centered on people requirements, a low credit score might cost your extra cash. So it then raises the brand new situations. Can you afford this type of expenses? Maybe not: not for those who have a low-income, otherwise even worse, you already have a fantastic debt. If you’re able to manage they, tend to that it changes how much cash family you can afford? Do you need to be satisfied with a smaller location to live?

Next part, i briefly review the credit score conditions for the most preferred loan versions. Not absolutely all lenders are exactly the same, and credit rating standards may differ from the venue. You really need to demand a loan top-notch for further guidance on those mortgage selection that be perfect for your credit score situation.

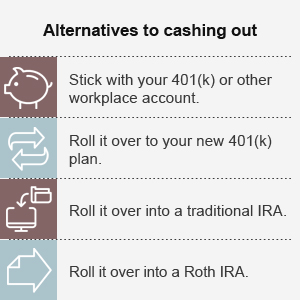

Before you can worry, remember that you’ll find solutions to a reduced credit score

The best way to establish this might be to start with a good high credit rating and you can talk about the altering mortgage options just like the you to definitely get reduces. Keep in mind: there are other factors, together with your earnings, loans, assets, down payment, and you will a career records, a lender need certainly to thought ahead of mortgage recognition. Even if you has a credit rating out-of 800, you might not qualify for a loan in the event that you can find inaccuracies into the aforementioned points.