If you have already called their bank to see precisely what the requirements was to own a small business loan, you have got already located the amount of files might not be individually for the state. On account of all red tape banking institutions have experienced particular of their subscribers wanting option choices on the business loans. Shorter files happens to be a very common practice inside the non-conventional loans, almost to the stage in which it appears these businesses will be too lenient.

Struck since the iron’s hot!

Before financial crisis away from 2008, banking institutions was indeed writing fund to anyone that you can expect to fog a reflect. Subprime financing and you will Alt-An applications caused it to be an easy task to qualify for a property loan, almost any person becomes a citizen. Depending on the timing, some individuals really benefited because of these variety of applications, they were able to and acquire numerous functions and both turned them for huge earnings otherwise leftover all cash advance america of them for their portfolio. Nevertheless trick here are their time, it took advantage of brand new applications which were as much as and from now on that people applications aren’t available anymore it is more difficult to get characteristics making money. Choice organization financing could be doing for as long as the brand new loans that are funded are performing. Unlike the mortgage crisis where these types of loans started to standard, the banks was required to stop money significantly less than those individuals parameters.

Protecting a corporate Loan with just minimal if any Paperwork

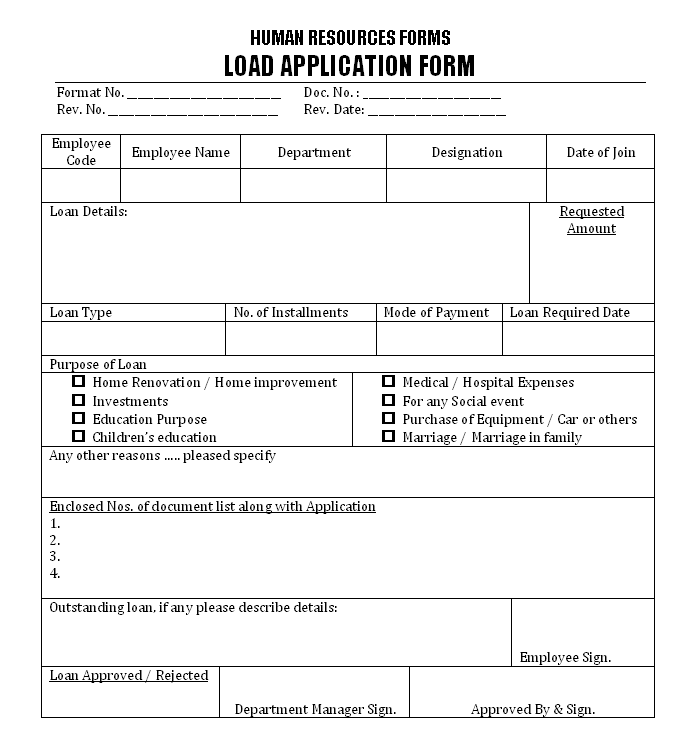

Of numerous loan providers generally speaking request consumers to accomplish an array of models, encompassing lender comments, house verification, tax statements, balance sheet sets, income recognition, and a lot more. When you’re an intensive documentation process can offer masters, additionally, it may establish excessively big date-sipping. Conventional financial institutions, noted for their slow speed, will exit borrowers looking forward to working-capital for extended periods.

Thank goodness one to small businesses now have the fresh new choice to obtain finance with minimal to no files requirements. To start with Investment Company Finance, i get rid of the significance of excessively statement of finance submissions to help you loan providers. We optimized the latest funding techniques having convenience and you will performance.

Accepting you to small business owners direct hectic existence, our very own reduced-records financing can handle speed, enabling you to allocate some time where it issues really.

Depending on whom you intend to match, they all provides different criteria. However the most common activities expected whenever applying for a working capital loan:

- three to six months bank comments out of most of the business bank account for the most latest days

- three to four weeks mastercard control statements for the most previous months for folks who team process handmade cards

- App (this really is from one or two users, but standard recommendations)

Barely can you come across lenders asking for tax returns or financials, but not it is really not uncommon into larger mortgage amounts. The things in the above list will likely be sufficient to get you an enthusiastic address if they offer a corporate financing. Change moments to acquire an answer is usually contained in this 24 era, if for example the financial/representative you are coping with are taking longer than a couple of days you may want to you better think again who you are using the services of. For those who commit to the brand new words you’ll have loan data files in as little as an equivalent time, and also at the period the lending company would-be asking for extra situations.

- Nullified glance at on the providers checking account to allow them to cord the funds

- Duplicate off Drivers Permit otherwise Passport to show you’re business owner(s)

- Sometimes they would want to do a web site review of your own providers and also make they think a little more more comfortable with the brand new loan.

- Copy out-of voided rental find out if your business is renting its place, when you have a mortgage they will certainly want to see their most recent home loan declaration proving that you will be latest.

- Verbal verification for the business person and also the money provider, might discuss the loan words into the entrepreneur once more to ensure they fully understand them.

We hope that can make you sensible about what will be requisite whenever trying to get a low-traditional business loan. There is another great site having a great deal of factual statements about business loans, here are some us out to find out more about business funding. However we have all a new scenario along with your problem was a small other, if you prefer to learn more go ahead and cam having our company innovation professionals. They can be reached from the 888-565-6692 .