The united states Service off Farming (USDA) is not just about meats inspections, additionally even offers home financing system one, with regards to the department, aided over 166,000 parents realize their property possession aspirations in the 2015 alone. The USDA Outlying Creativity Solitary Loved ones Casing Mortgage Make sure System, or USDA Financial, also provides multiple benefits you’ll not discover with other mortgage software. Home buyers have used that it regulators-supported program given that 1949 to finance home they wouldn’t pay for as a consequence of antique pathways by using advantage of its tall professionals.

Zero Deposit

The most significant, biggest benefit of good USDA mortgage is the zero advance payment requirements. Which conserves home buyers a lot of initial money, which is often top obstacle in order to owning a home. Most other low down fee solutions want limited amounts that usually initiate during the step three%, however with USDA loans your take advantage of no-down on financing equivalent to the fresh new appraised property value this new household getting ordered. The ability to obtain 100% resource is considered the most quoted work for this choice will bring.

Lenient Applicant Qualification Conditions

Fund are available for individuals having lower fico scores and even derogatory credit facts or minimal borrowing from the bank histories may not hurt your own eligibility for home financing. The newest USDA has actually flexible credit conditions than the other kinds of funds. Applicants only need a rating off 640 for automatic acceptance, however, straight down credit ratings are occasionally approved with Yourself Underwritten fund, with stricter criteria. The brand new USDA plus has no need for the absolute minimum a job history about exact same job. not, you do you need proof of steady money for the earlier in the day one or two age, particularly if you might be out of work, by way of taxation statements.

Lower Monthly Individual Home loan Insurance (PMI)

Whatever the mortgage program, one mortgage having below 20% down-payment must hold PMI. Although not, PMI is significantly less costly that have an excellent USDA mortgage and you can is called verify charge. These types of fees is an initial and you can yearly charge. A unique benefit of a beneficial USDA mortgage are these costs were a minimal PMI rates of any mortgage program. Currently, the brand new upfront commission try 2% additionally the annual percentage is actually .50%, but these are prepared in order to , centered on home loan benefits eg Inlanta Financial. A vacation benefit ‘s the capability to financing their upfront PMI by moving it to your financial support, in order to intimate in the place of putting any money off.

Competitive https://paydayloancolorado.net/brandon/ Annual percentage rate (APR)

Your no-down payment USDA home loan does not always mean you are able to shell out a highest Apr. This type of finance offer similar, if you don’t straight down, rates than simply you’ll find that have traditional funds or other formal family mortgage programs such as Government Houses Expert (FHA) fund. Because these financing are protected by government, lenders render low interest rates that’ll not vary centered on your own down-payment otherwise credit history, because they perform which have traditional capital. Your make use of 15-year and you may 29-12 months fixed interest levels one rival the fresh cost out-of almost every other reduced-notice reasonable applications.

Low Monthly premiums

As a result of the zero-down payment, you wind up that have a higher financed equilibrium with USDA financing, but it is commonly counterbalance by the all the way down, less expensive PMI and you may e, otherwise either straight down, than other loan possibilities, which especially pros group towards rigorous finances.

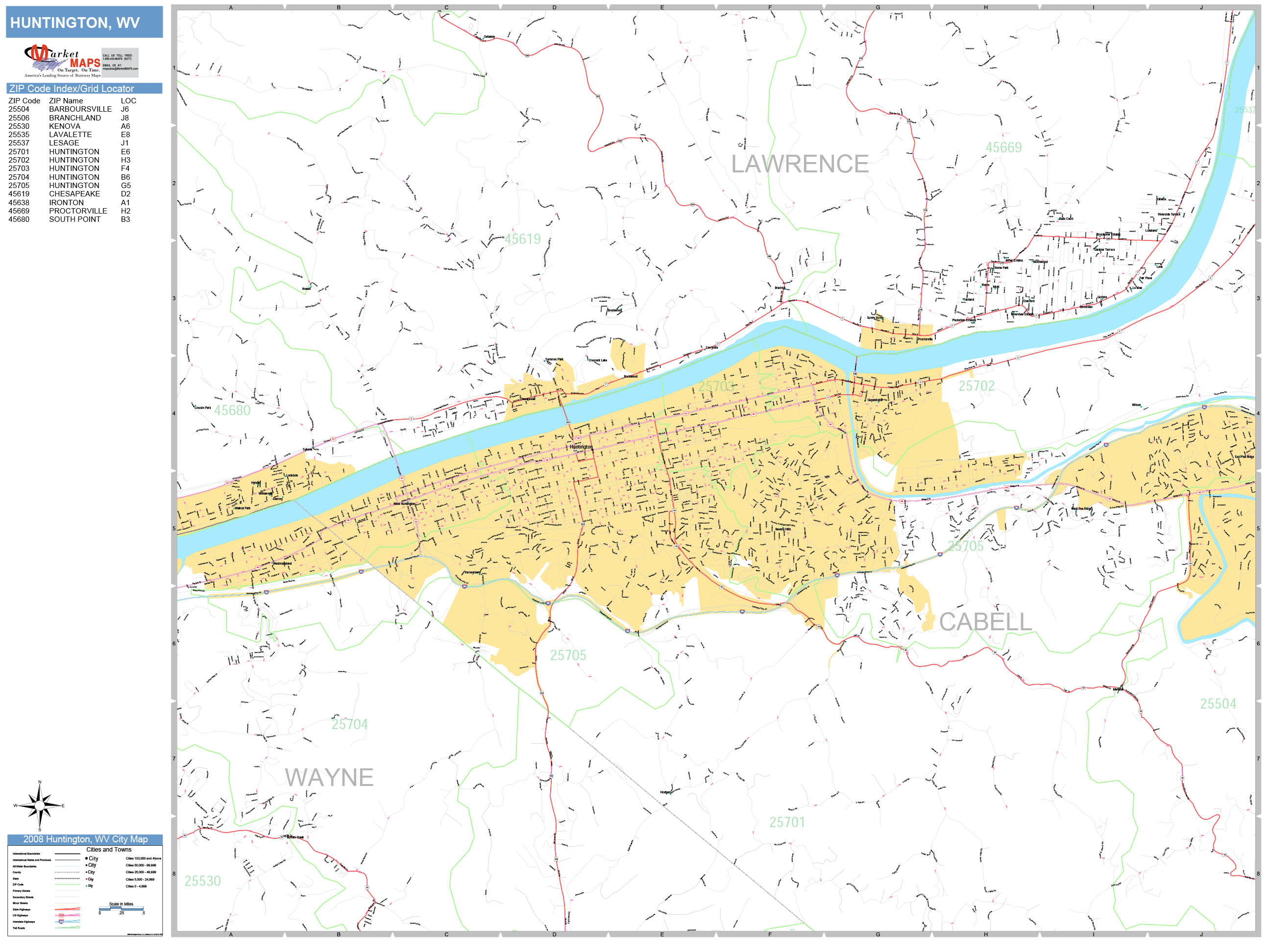

Numerous Area Availability

Because the financing is actually given to own “rural” portion, the newest USDA definition of rural is actually liberal. Depending on the Home loan Report, on 97% out of result in the fresh You.S. is eligible. Basic recommendations condition prospective qualities must be within the portion which have a beneficial people lower than ten,000, or 20,000 during the parts considered getting a life threatening not enough home loan borrowing from the bank to own lower/moderate-money family. Outlying categories are not likely to change up until 2020. Of numerous suburbs out of places and you will quick towns slip during these advice. A lot of areas nationwide has many city considered rural together with extremely outer sleeping regions of the greatest urban centers. Such as, Allentown, PA is too high so you’re able to meet the requirements due to the fact an eligible rural area, but shorter boroughs from inside the Lehigh Condition, particularly Coopersburg do. Rating a broad concept of licensed towns and cities because of the consulting a USDA qualification chart and you will be sure whether particular home meet the requirements during your financial lender.

Think of, the brand new USDA will not fund your financial. It people that have accepted loan providers that ready to write financing which have attractive words in order to accredited applicants that have a fees make certain away from the newest Rural Creativity Home loan Be sure System. While you are there are various advantages of a beneficial USDA mortgage, you will be however subject to every qualification requirements of system, thus not everyone will meet the requirements.

If you purchase something otherwise register for a free account by way of an association towards all of our site, we possibly may discovered payment. By using this website, your accept to the Associate Contract and concur that the clicks, affairs, and private advice is accumulated, filed, and/otherwise kept because of the all of us and social networking or any other 3rd-party couples in accordance with the Privacy.

Disclaimer

Entry to and you may/or subscription to your people portion of this site comprises enjoy from all of our Affiliate Contract, (upgraded 8/1/2024) and you will acknowledgement of our Online privacy policy, plus Privacy Possibilities and you may Legal rights (up-to-date eight/1/2024).

2024 Improve Regional Media LLC. The liberties reserved (Regarding All of us). The information presented on this web site might not be reproduced, delivered, carried, cached or otherwise used, except towards the prior written consent from Improve Local.