This Particular utilizes Brigit’s protocol in purchase to predict any time you may operate reduced on cash plus automatically includes you to become able to stay away from a great undesirable overdraft. Response a few of speedy queries, and PockBox will quickly retrieve financial loan quotations through up in purchase to 55 lenders, therefore an individual can discover the provide that will functions best for a person. Sawzag will be one of the many extensively utilized borrowing programs, and our amount choose regarding when a person require in buy to obtain cash quickly. As Soon As an individual examine if this particular feature is usually accessible in buy to an individual, it’s a quite straightforward process.

Action 1: Verify Your Own Membership

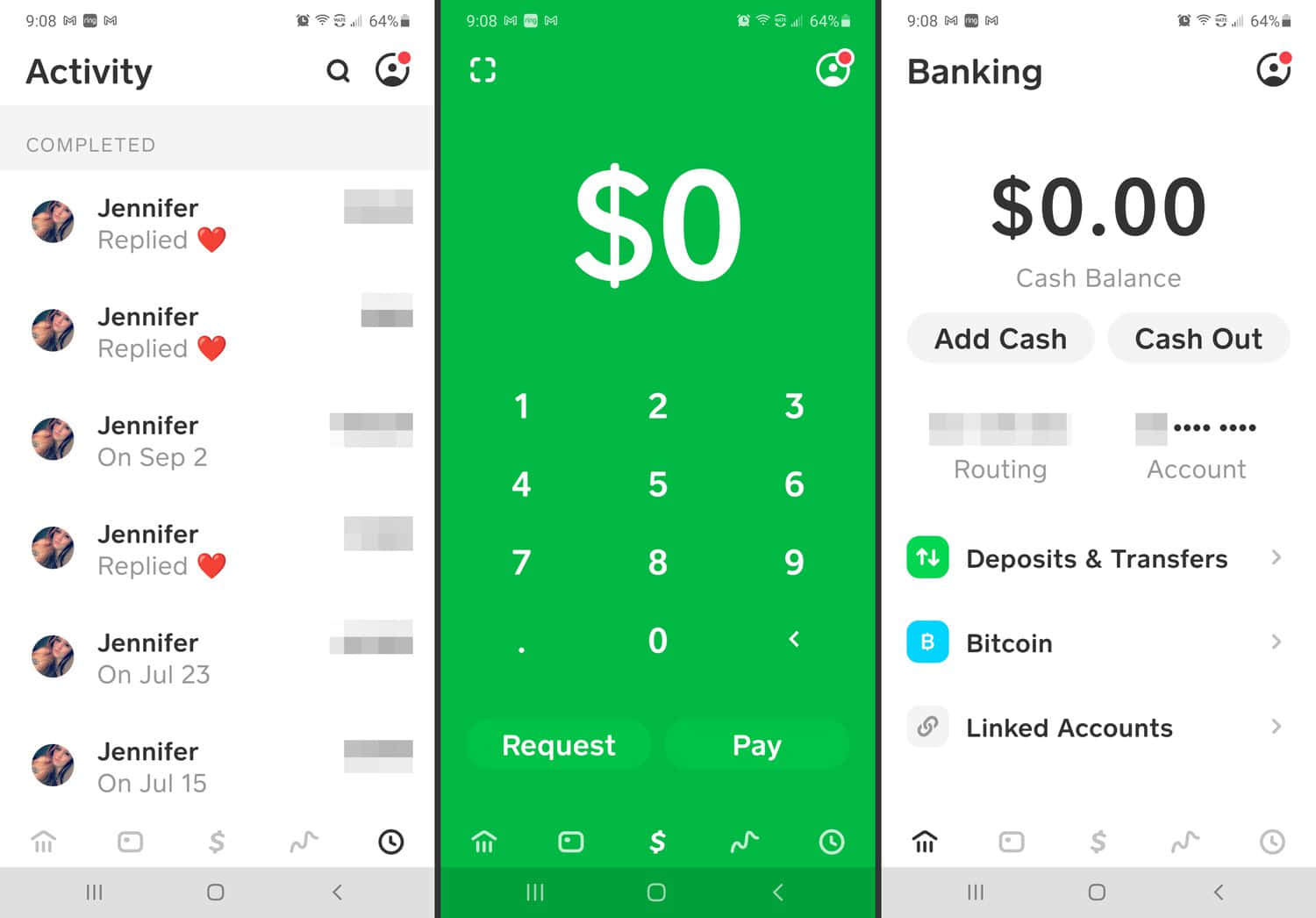

To locate away in case a person’re entitled to become in a position to use Borrow, click the Money button upon the bottom remaining of the app’s house display screen. In Case a person don’t see Borrow within just your application, you can’t consider out loans today, nevertheless you may become able in order to inside the long term. Based to become able to a Cash App spokesperson, only particular prescreened customers usually are entitled to use Money Software Borrow. Borrow is usually invite-only, and membership is determined by simply factors such as where you reside (the characteristic will be available within thirty-six says only) in add-on to your action within just the particular software itself.

Greatest $50 Mortgage Immediate Programs On The Internet: Zero Credit Rating Check, Simply No Primary Down Payment Required

Before we move upon to be capable to show an individual just how in purchase to borrow funds coming from Money App, we require to tell an individual this particular is usually a limited function for now. And regrettably, Cash App is usually furthermore quite secretive regarding exactly how it determines membership. When you tend not really to satisfy their membership specifications, you will not end up being capable in order to employ typically the borrow function on typically the Cash app.

An Individual may tell when you’re capable in order to borrow money from Funds Application since the option will become available to become capable to you upon typically the primary menus. Just About All a person require to do is faucet the particular alternative, and you’ll become used to end up being capable to a page where you can read precisely how typically the characteristic functions plus borrow money upward to be capable to typically the limit regarding $200. Klover will link to end up being in a position to your current bank account through Plaid in add-on to examine your own most recent transactions. Within (totally NOT) amazing news, recurring deposits are usually typically the key criteria to be able to credit scoring a funds advance.

Coronary Heart Paydays, on typically the some other palm, sticks out with regard to their inclusivity, larger mortgage amounts, in add-on to translucent phrases. Whether you’re going through a good emergency or planning a considerable expense, Coronary Heart Paydays guarantees a smooth borrowing knowledge focused on your requires. This Specific characteristic should be applied fairly given that a person need to pay off inside typically the subsequent days.

Feasible Finance is usually a payday mortgage alternative that gives loans of upwards in buy to $500. Typically The app costs lower attention prices than standard payday loans, and a person can repay the mortgage in installments over a couple of a few months. Overall, in case a person employ Funds App Borrow reliably plus create regular repayments, it could have a good influence on your current credit rating score.

It’s created with consider to fast access to become in a position to funds any time you require it most, just like with consider to unforeseen expenses or bills. I keep in mind the particular very first time I used it; I has been quick on money before payday plus it experienced like a lifesaver. A Person may borrow between $20 in addition to $200, which often is usually fairly convenient for tiny requirements. You might become able to borrow once again proper right after spending away your loan. Yet, your own membership in inclusion to borrowing restrict for long term loans could be impacted by simply your own repayment historical past and exactly how Money App views your creditworthiness. Constantly pay off upon moment plus borrow responsibly in buy to enhance your chances regarding getting accepted once again.

To meet the criteria, a person must end upwards being at minimum eighteen many years old, plus eligibility is limited to inhabitants regarding particular declares. In Case you be eligible, a person can find Cash Application Borrow within just a pair of steps. However, Cash Application staff keeps normal contest in addition to giveaways upon their official social media company accounts.

- Cash usually are typically available immediately right after verification of your borrowing request.

- Several monetary institutes pick Caldwell as the particular excellent source with respect to educational personal financing content material.

- They’ve already been testing a new function that allows an individual to borrow money straight through the particular app.

- Funds App provides quickly grown in to 1 associated with the particular most-used e-money applications inside the particular planet today, helping more as compared to fifty five thousand customers simply by the conclusion of 2023.

- The Particular Funds app is a well-known in add-on to easy program in order to transfer funds through your bank accounts by implies of a smartphone software within typically the Combined Declares and typically the Usa Empire.

Is Usually It Safe To Employ Cash Software For Borrowing Money?

So if you’re brief on funds and want to be capable to borrow cash, will be it sensible to cash advance borrow money make upward the shortage with a Money Software loan, plus are usually presently there possible hazards involved? As with most things, presently there are definite benefits plus drawbacks. PS spoken with finance expert Travis Sholin, PhD, CFP, in purchase to find out exactly what possible customers need to realize about just how to be capable to borrow cash coming from Money App. If an individual meet these requirements, you’ll most likely be provided various levels regarding borrowing choices.

Does Borrowing Cash Coming From Funds App Aid A Person Build Credit?

As we described, typically the Cash Application Borrow feature isn’t obtainable to each Money Application customer. Rather, it’s honored based about outside needs that will many could only guess at. A Person can quickly verify to become capable to see in case you possess Cash Software Borrow entry by starting the particular application and pressing on your account balance within the lower left-hand nook. Click typically the house symbol to get around in buy to the banking area associated with typically the app. Even Though presently there is usually simply no official program procedure in buy to be eligible for a Cash Software Borrow mortgage, you will need in order to be a great current associate and have got a great accounts that’s already been active with respect to a although.

End Upward Being certain to evaluate curiosity prices plus charges just before selecting a lender. If an individual possess bad credit, a person may have less choices obtainable to end upwards being in a position to an individual, nevertheless it’s nevertheless feasible to be capable to look for a financial loan that functions with consider to you. Chime is usually a cell phone banking software that will provides an overdraft feature.

- But, your current membership and borrowing limit for upcoming loans may end up being impacted by your current repayment historical past in add-on to just how Cash Software views your current creditworthiness.

- A Person need to at the very least link your current lender bank account and regularly put money in purchase to your Money Application.

- Credit historical past alone will be essential any time it will come to end upwards being in a position to any type of loans.

- Typically The Cash App Borrow loan is not really meant to become a long-term answer.

- Money Software will inform an individual associated with your borrowing restrict during the procedure.

Empower allows an individual ‘Try Before A Person Buy’ with a 14-day totally free demo regarding first-time customers. Nevertheless view out there – add in high express fees and acquire cajoled to be in a position to depart idea, and you’ll see why we identified Empower to end up being able to become 1 regarding the costlier applications that will provide an individual funds. As a membership-based cash advance, B9 arrives together with simply ONE fee together with simply no express fees, optional suggestions, or late charges.