Of numerous homeowners may want to renovate otherwise redesign their houses so you can improve effectiveness, increase worth of, or maybe just enhance the appearance and you can end up being of its living spaces. If you are intending property renovation, you are probably wondering just how you’ll financing it. Renovations can be expensive, and lots of home owners often don’t have the dollars best personal loan lenders in Windsor to fund all of them outright. The good news is, there are many possibilities which can help you fund your plans.

Understanding family renovation

Home repair are an elaborate processes, it is therefore a smart idea to see the rules and now have planned earlier their excursion:

- Describe the fresh extent of your home renovation investment. Have you been likely to redesign your kitchen otherwise create another type of space? Or are you willing to only want to use an equivalent color color in the entire home? Which have a definite idea of what you ought to to complete usually help you estimate the expense of materials and you may service providers your must get to discover the employment done.

- Lay a spending plan for your repair. Consider that cost of work and you will product usually generally speaking end up being the greatest debts of a restoration enterprise. Keep in mind that work can cost you can vary according to difficulty of your opportunity and you may probably the experience level of this new contractors you may be handling. According to scale of your own recovery otherwise upgrade, you may need to receive it allows from your own state government, making it important to basis such into the finances too.

- Think about your financing selection. Because the making home improvements may start out over feel a big expenses, you will need to has actually a strategy positioned to pay for pay money for assembling your project. This would were space to cover any unexpected will set you back that come since the techniques has begun.

- Look builders and you will services. Find gurus which have expertise in the sort of recovery you happen to be seeking to over and be sure to inquire of for references and you will evaluate background prior to signing any agreements. Plus, contrast the expense of content ranging from multiple source and ask for prices from additional designers to better understand what the choices are.

By the understanding the principles off household recovery and you will concerning ideas you would like to have finished, you may want to help the possibilities which you’ll features a mellow and low-stress sense.

Financing your residence repair

Regarding capital your property renovation, you have a number of options to explore and view what might become on the market. Listed below are some of the very most common an approach to financing their home improvements.

Have fun with offers

When you yourself have discounts arranged, it a way to obtain loans to suit your investment. By using money you have on your bank account, you’ll not need to pay any attention costs otherwise costs to your a loan. Before you remove from your own coupons, thought making an expense that will help you feel prepared for problems.

Handmade cards

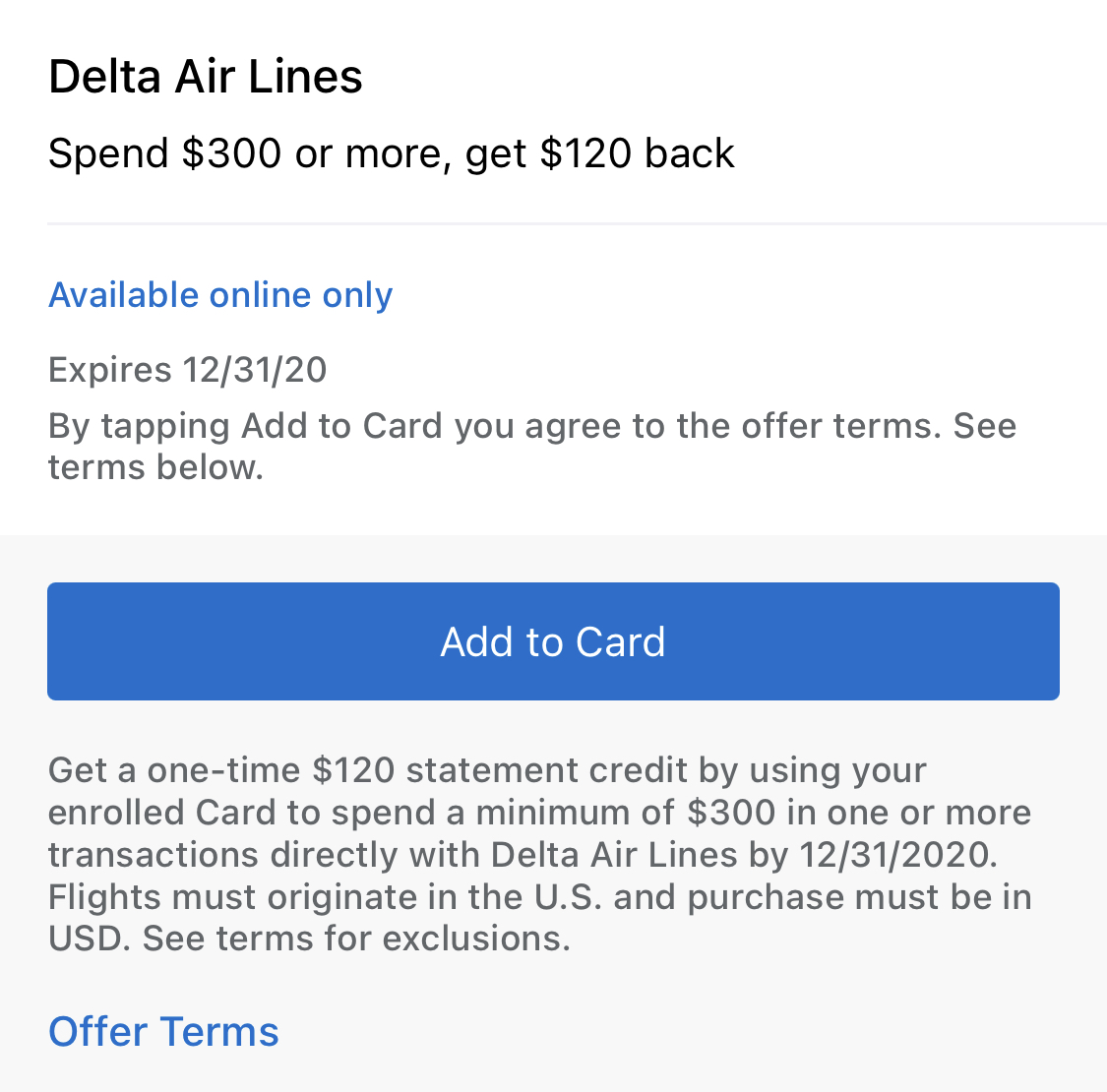

Playing cards could be a better option to purchase house developments when compared to bucks. Of several notes have different forms out-of protection and offer new power to invest the brand new owed count when you look at the monthly obligations unlike an effective lump sum payment. not, mastercard yearly fee rates (APRs) are more than most other credit lines and you also ount when you look at the funding fees if you can’t pay the card out-of quickly.

Home equity finance and HELOCs

A house collateral mortgage allows the fresh new resident to use the significance of the house due to the fact guarantee. Given that a home equity loan is backed by guarantee, the typical rates are often lower than mastercard APRs or other personal loans. This type of financing usually has a predetermined rate of interest, fixed payment name and you may fixed monthly installments. As well as lower rates of interest, household security loans feel the additional work with your attract costs toward specific renovations is generally tax deductible (speak to your income tax mentor to choose for many who meet the requirements). Although not, if you’re not able to pay, you could potentially reduce your residence.