House Borrowing N.V. (HCNV) was a respected consumer funds supplier concentrating on growing locations. House Credit’s mission would be to offer consumer fund responsibly, specifically to those with little to no or no credit rating, via a beneficial multichannel on the internet and offline shipment model and therefore emphasises digital functions and you may devices.

HCNV try a parent business organised toward several local groupings. It retains equity appeal from inside the consumer financial institutions round the multiple locations inside the China and you may Europe. From inside the more 25 years out of functions, the company has developed a diverse selection of imaginative and you can reasonable monetary attributes and you may choices customized into the social, public, and you may economic subtleties of every of segments in which it operates.

The group works into the nations in which gains potential was high, GDP development is actually a lot more than average and consumer loans entrance rates are reasonable. By the end from 2023, Domestic Borrowing from the bank Group enterprises was serving up to 6 mil energetic customers across the almost all their ong the greatest and you will bestranked point-of-selling funding brands.

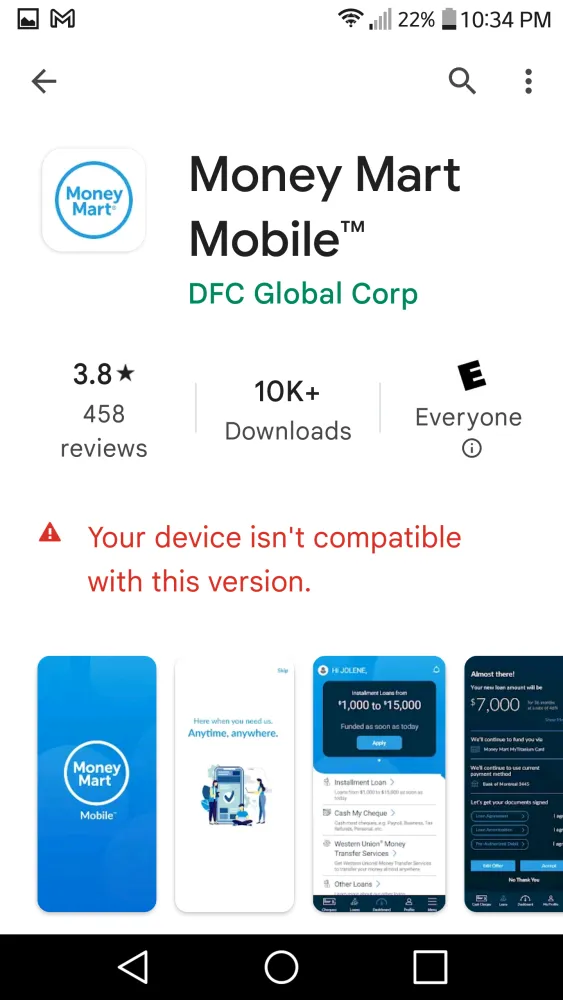

Inside the a consistently evolving digital world, the group’s mission would be to render highly competitive functions while maintaining an exceptional level of agility and you can innovation. Advanced tech and Domestic Credit’s easy-touse mobile software bring inclusive access to borrowing from the bank attributes. Domestic Borrowing utilizes a keen omnichannel means because an adaptable and you will responsible cure for render underserved and you can unbanked customers accessibility brand new financial characteristics community, tend to on the first time. The in control credit conclusion important to House Credit’s business structure try produced precisely and swiftly through Family Credit’s studies-centric functions, and that mark on predictive gadgets and you may investigation research.

Household Borrowing from the bank

Domestic Borrowing also provides around three categories of unsecured user finance situations to your its areas point-of-profit money, useful otherwise cash funds, and you may rotating borrowing circumstances. Along with funds, Family Borrowing from the bank now offers consumers complementary products particularly insurance policies and you can third-class insurance policies distribution. The business’s device approach will experience large customer loyalty with characteristics you to definitely operate well on actually ever-switching demands and life situations that individuals face across all ages groups.

In the 2023, Domestic Credit’s center areas educated extreme development in regularity, largely driven because of the wide economic recuperation. Just last year was also well known on the completion of the conversion regarding Home Credit’s Indonesian and you can Philippines sections, all of which were received of the an excellent consortium from Japanese economic organizations Mitsubishi UFJ Monetary Class and you may associates added by the Krungsri Lender, a popular Thai place, for https://paydayloanalabama.com/fayetteville/ the selling value around EUR 656 million.

Internationally, the firm went on to help you accelerate digitalisation, which included the newest firmer consolidation from mobile applications to switch the newest buyers experience and interaction in mortgage costs, in order to explain the acquisition out of user merchandise using on the web retail partners. More 90% of your own organizations business is passionate of the mobile devices, and you can Family Credit’s programs features over 100 million registered users internationally because they circulated.

Household Credit Classification remains accepted since the a leading in charge agent regarding the Czech Republic and you will Slovakia. Into the 2023, House Credit ranked first-in people in need separate evaluation blogged as In control Credit List. Family Borrowing plus will continue to focus on exploring the fresh funds channels, for example insurance policies distribution, and on development new clients issues.

Into the ework arrangement to market 100% of its Home Borrowing from the bank Vietnam company to Siam Commercial Lender out-of Thailand. The transaction was subject to regulatory approval that will be expected to become completed in the original half 2025.

CSR circumstances

Home Borrowing India’s Saksham investment, run in partnership which have IDF, provided fi nancial literacy degree so you’re able to 29,0. Within the Vietnam, Household Credit’s Household forever enterprise, focusing on 500 domiciles, given disadvantaged women having interest- totally free money and you will fi nancial degree.

The new House Love step distributed gift suggestions and you will rules all over the country, and a new playground into the Bac Lieu and you can enjoying clothing to have countless children when you look at the Ha Giang. Over 1,500 Domestic Borrowing group participated in charitable activities.