Of a lot borrowers worry about discovering its deposit and you may you should initiate protecting early to them. As well as, start early, exactly what else in the event that you understand home loan down money?

Particular consumers who do work on their credit well before applying for that loan can be eligible for an educated down-payment conditions. You are expected to create a much bigger deposit in the event that your credit rating is simply too lower; financial conditions plus the home loan system you implement below usually features a declare with what that high down payment will be.

Conventional off money will vary, but if you don’t should shell out 20% so you can eliminate individual financial insurance, you will change a lower advance payment towards the individual financial advanced, which are often payable if you don’t visited 20% collateral at your home except if other arrangements is agreed upon.

Good Va debtor typically helps make Zero deposit except if he or she is trying to reduce the number of the brand new Va mortgage investment commission, hence decrease depending on how much downpayment you make. USDA financing have a similar zero-money-down feature, however, USDA funds was you need-created, and then have children (Not individual) money limit that may apply regardless of how many people are required towards the loan.

Virtual assistant loans try for being qualified armed forces people, USDA finance is actually you want-situated. FHA mortgages, in comparison, are much much more available to regular domestic hunters making use of their reduced step three.5% down-payment criteria from inside the normal times.

Look at the substitute for sign up for a city downpayment assistance otherwise homebuyer’s grant with an FHA financial. You can even discuss to the provider to include a specific level of help from the vendor to possess closing costs.

Your downpayment costs might not started 100% with your own money having let along these lines, however the FHA has nothing to do with such as transactions and you may it might be for you to decide locate a down payment guidelines package on your own geographic area.

FHA funds might provide the proper debtor towards the help a great debtor has to look for or generate yet another house, possibly the very first time aside. Talk to a participating financial regarding your FHA financing options.

Related Home loan Stuff

The latest Government Homes Administration (FHA) have announced higher FHA loan restrictions getting 2025. They are the financing limits getting unmarried-household members homes purchased according to the FHA financing program to own domestic real estate around five units in size.

What exactly do you have to know on the mortgage denial? Using FHA loan providers consider several factors when it comes to a keen FHA financing application, and being aware what they look to possess makes it possible to best ready yourself to possess next time.

FHA loan rules permit down payment assist that meets FHA and you can financial standards. You can get down-payment gift loans assistance from your state agencies or any other bodies program, mothers, and you can businesses.

First-go out homebuyers are usually concerned about the level of the deposit criteria with a brand new mortgage. That is a primary reason FHA mortgages are popular with qualified borrowers – the 3.5% advance payment demands is a wonderful replacement most other mortgages.

An FHA home loan exists to help you whoever financially qualifies and you will is not limited by first-date home buyers otherwise anyone who has never ever owned possessions in advance of. Such Va home loans, and you will USDA mortgages to own outlying parts, this new FHA home loan system are an authorities-supported financial.

FHA home loans are not simply for first-time homebuyers, nevertheless the FHA financial program is an excellent selection for people that have never owned property prior to–there can be the lowest deposit specifications and much more versatile FICO get guidance to own FHA mortgages.

Associated Home loan Words

Settlement costs involve every charge and will set you back that need so you can be distributed ahead of otherwise during closure. Your own home loan contract and you will disclosures talk about all costs you to definitely would-be sustained by you because buyer, the seller, additionally the bank.

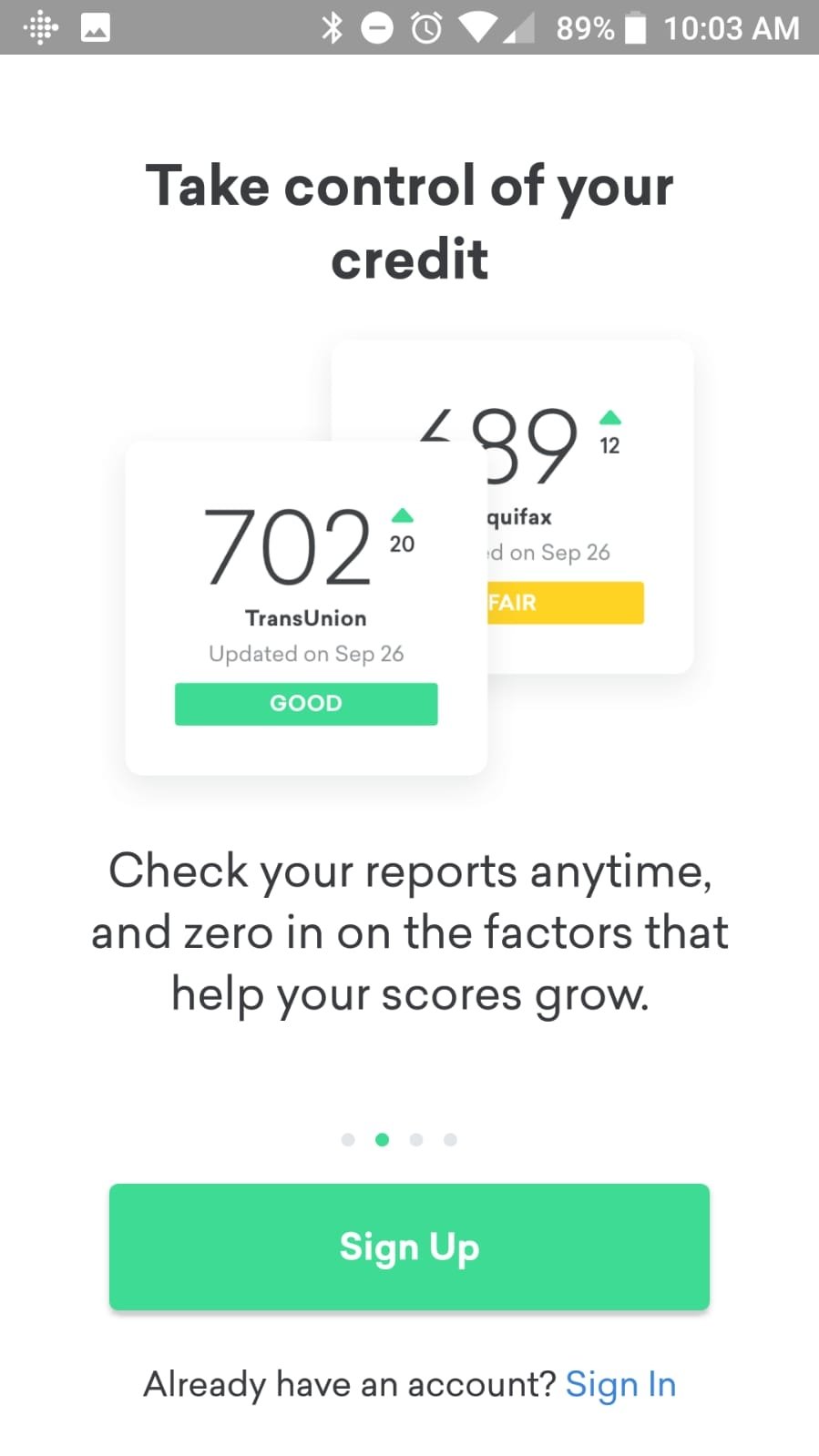

Your credit score was a variety you to definitely means your creditworthiness so you can loan providers that happen to be determining whether to offer your that loan. Fico scores will be extremely widely accepted credit ratings.

The new deposit on your own residence is extent you only pay the financial institution initial so you can contain the loan. The quantity differs based on what you are able manage, additionally the mortgage standards you to definitely are very different with respect to the lender.

Household security is the level of ownership you have on your house. This new guarantee in your domestic expands because you create money, as you very own more of they.

Your own bank is the person otherwise establishment giving your a mortgage mortgage. Loan providers financing your money to get a property, for the with the knowledge that might generate typical repayments, with attract, to pay off the loan.

When shopping for a different sort of house, most people get a mortgage to money it. This might be financing enabling one to borrow funds so you can find the property, and make monthly premiums to repay the debt which have notice.

Associated Concerns and Answers

Since typical FHA financing candidate has created some kind regarding credit history, specific borrowers are only starting out. A borrower’s choice to not have fun with or introduce credit to establish a credit history is almost certainly not made use of as the basis for rejecting.

Perhaps one of the most important aspects of getting your credit rating fit before applying having a keen FHA home mortgage are big date. If you feel your own borrowing is within worst contour, you ought to introduce fee precision over a period of on the very least one year end up being.

Refinancing mortgage is a great selection for consumers who want so you can re-finance for the less interest rate otherwise payment. Improve refinance financing allow FHA consumers re-finance with no constantly required assessment or credit assessment.

Doing your research for the right home loan will help you select ideal financing kind of an enthusiastic the best price. Home financing is actually something, identical to a car or truck, and so the rate and terms and conditions are negotiable. You ought to compare every will set you back involved, should it be to own a good h.

Information exacltly what the payment per month or the interest could well be isnt enough. Request facts about funds with the exact same amount borrowed, but with some other loan terms or https://paydayloancolorado.net/hoehne/ mortgage brands and that means you normally compare one suggestions.

Mortgage insurance is an insurance plan you to covers loan providers facing losings you to come from defaults for the home mortgages. FHA requires each other initial and you can yearly financial insurance rates for everybody borrowers, no matter what level of downpayment.