Articles

For those who require a regulated portfolio and you can advice, robos is actually far far better than the traditional common fund approach. There’s nothing more important to possess a trader than simply left in this your exposure threshold peak. By taking to the a lot of exposure and you can bail on your opportunities while in the field modifications, you make long lasting loss. It was told you the only a portfolio is but one you could live with because of all of the highs and lows from the marketplace. You can create a passive profile in as little as one step, create a cautious number of mutual fund otherwise ETFs, or go all-in the because the a self-led individual. You can decide which suits you with truthful solutions to a few concerns.

Settee Carrots Voucher FAQ

The theory is that, it portfolio should provide far more diversity, quicker chance. These gummies are federally judge to shop for on the web when you’re more than 21 years of age, the brand new delta-9 try acquired away from hemp, and the THC blogs is below .3percent by deceased weight of your own completed unit. Choosing the correct quantity of THC gummies when planning on taking relies on multiple items, mainly the newest milligrams of THC inside the per gummy and your personal endurance.

Which idiom can be always explain someone who uses most of their time seated or lying down to the a sofa, watching tv otherwise doing practically nothing. The phrase was ever more popular recently since the all of our area gets to be more sedentary. Justin has updated their popular calculators, which you’ll obtain 100percent free for the the new Calculators section of one’s PWL Money website.

Talking about edible treats infused which have Delta-9-tetrahydrocannabinol, an element of the psychoactive compound used in marijuana that provides the fresh antique ‘high’. This type of gummies offer a managed and fun way to experience the results of THC. If the yield for the ten-year government securities spiked earlier this 12 months—from a single.88percent on 16 all the way to 2.55percent to the July 5—the worth of wider-centered bond ETFs plummeted sharply. But We’ll wager a large number of buyers consider its thread ETFs are trying to do worse than they are really. The new 3d video game cannot offer added bonus series or 100 percent free revolves however, provides a plus ability and you will a good jackpot that isn’t progressive.

As the advertised the 2009 year, their get back in the last three years has been much better than the product quality Inactive. Regardless, the notion of having seven to help you 10 money, in numerous size, is enough to cause the majority of people to depart the area. Delta-9 gummies usually take from half an hour to 2 hours in order to activate. You will need to provide the gummies plenty of time to kick in just before eating up more, since there can be a delay effect inside use.

This type of one hundredpercent bond ETFs are perfect for lower-risk people however, deal with an identical fixed-earnings dangers we have mentioned before. https://happy-gambler.com/silver-city/ History to the Canadian Couch potato’s design collection list is this type of three bond ETFs provided by the same money executives because the prior to. Such ETFs is actually strictly thread ETFs and therefore are perhaps not thought region of each of your about three executives’ all-in-you to roster.

Why Is Settee Potatoes?

However, I believe we can the agree that rebalancing a two-financing portfolio isn’t likely to eliminate a lot of notice cells. Dan Bortolotti, CFP, CIM, try a profile manager and you will monetary planner having PWL Financing inside the Toronto. He or she is in addition to a seasoned writer and blogger who has discussing private fund for most Canadian books, including MoneySense, earth and you may Send and Financial Article.

To put it differently, Canadians pay a few of the higher charges international in order to spend money on positively addressed shared finance; on the dospercent happens off the greatest of the equity fund’s income before you can discover a reddish cent. The new lazy inactive individual is create a collection for less than simply 1/ten of the cost—a lot more like 0.2percent otherwise shorter—which means that far more money income move in the account as opposed to your advisor’s. The brand new investment allotment ETFs introduced from the Leading edge and iShares inside the 2018 have actually made it simpler than ever to own people to build a low-prices well-balanced profile. If you want a globally diversified combination of 80percent holds and you may 20percent securities, for example, the fresh Innovative Progress ETF Profile (VGRO) tend to deliver by using an individual exchange.

For each and every means has its own benefits and drawbacks, and you may buyers should think about such things whenever choosing a financial investment strategy. In the event the a trader provides a reduced chance threshold which can be looking to money, they could see directory finance otherwise ETFs you to definitely invest in ties or other fixed-money bonds. While the collection is established, the newest buyer merely needs so you can rebalance they from time to time to keep up the fresh wanted investment allotment. But not, if the couch potato collection loses quicker, what’s more, it growth quicker. Looking at the 10-year months 2010–2019, the new S&P five hundred is back 12.97percent and also the couch potato profile 8.48percent.

- While i compared the new Complex Portfolios in the March 2022, the brand new balanced progress collection try in top, due to its greater allowance to help you brings.

- Ahead of going to the site, delight read the Disclaimer and you can Rules webpage.

- Justin now offers a dramatic illustration of how a trader who generated a big contribution ahead of the brand new economic crisis out of 2008–09 have had an excellent TWRR over cuatropercent whether or not their collection actually missing worth.

- Investors is certainly using the extra geopolitical dangers of development countries under consideration.

- You’ll i enhance the go back—or slow down the risk— adding more income?

- Funds-of-fund like most of one’s of these safeguarded above give you accessibility to many ETFs in one head ETF.

Interestingly, your butt Potato Profile reached a lower CAGR compared to the S&P five-hundred, having around 1 / 2 of the fresh volatility, much reduced drawdowns, and far greater risk-adjusted go back (Sharpe). This can be in the bonds carrying out their job out of protecting out of the fresh disadvantage danger of brings. Supplied, a lot of now several months – just after 1982 – is ideal for bonds. This process will bring multiple advantages, as well as reduced fees and you can exchange will cost you, an inactive way of paying, diversification thanks to directory financing or ETFs, and you can possibility a lot of time-identity growth. They are able to along with let traders dictate the chance endurance and financing wants and supply knowledge for the risks and you can benefits of passive spending. That it allowance might be in accordance with the investor’s exposure threshold and financing wants.

SPAXX compared to. FZFXX, FDIC, FCASH, FDRXX – Fidelity Center Condition

Conservative investors would be to allocate an elevated to share with you in order to securities (that are less risky) much less to help you brings. Aggressive traders may take a lot more risk from the allocating increased ratio to stocks. Most investors would be better-served by a balanced collection out of somewhere within 31percent and you may 80percent carries. While most investing tips derive from picking individual carries, to make monetary predicts, and you can time the fresh locations, Couch potato traders recognize all of these points try counterproductive. They know you to traders offer themselves a greater danger of success by simply accepting the brand new output of your wider stock and bond segments. The problem is one to exactly why are experience on the a spreadsheet doesn’t constantly hold-up inside the real world.

Ideas on how to Buy Canadian Passive’s Doing it yourself ETF Portfolios

Immediately after all the cash is on the the newest membership, you could potentially build your the new Couch potato profile which have ETFs otherwise directory common financing. That’s rather easy but it mode our company is always paying fifty to help you 67 percent of our own profit equities— the usual set of “balanced” money. A blog designed for Canadians who want to find out more about paying having fun with index shared money and you may exchange-traded financing.

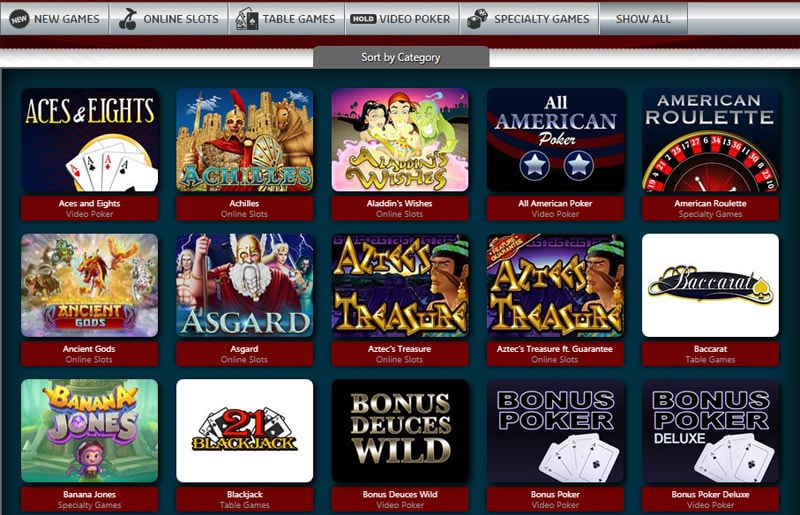

Variation in addition to lets investors to recapture the potential production of several field places, resulting in a possibly highest complete return on investment. By comparison, couch potato using is designed to replicate the brand new performance away from a standard field index, ultimately causing straight down costs and you may expenditures. Particular web based casinos can give the overall game within their applications therefore you will discover in case it is placed in the new video slot possibilities. There’s no special software required for cell phones, but you’ll you would like a thumb player for the desktop otherwise notebook.

On a single time, Trader 2 desires an excellent twenty-five,one hundred thousand detachment in order to meet surprise bills. Since the collection manager made use of the exact same technique for each other investors, the guy shouldn’t be rewarded otherwise punished to your aftereffect of cash moves over which he had no handle. To explain, inside the seventies a famous label for the tv is actually, “the newest boob tubing” which had been coined by people who sensed viewing television is actually a pursuit merely liked from the dumb. As the edible element of a great potato bush is known as an excellent “tuber”, it’s aren’t thought that the definition of “passive” try meant because the an imaginative blend of these basics.