When could it be a very good time to Refinance FHA To help you Conventional?

Homeowners exactly who refinance away from an FHA (Government Construction Government) financing in order to a conventional loan may experience monetary gurus, such decreasing its month-to-month mortgage repayments and overall offers. Understanding the differences when considering these types of mortgage items, in addition to issue such as for instance PMI (individual home loan insurance rates) and you may loan terms and conditions, is vital when it comes to a traditional mortgage refinance.

This informative article talks about the procedure and you can great things about refinancing from a keen FHA mortgage so you can a traditional home loan, reflecting important aspects to look at when transitioning anywhere between this type of mortgage brands.

Would you Refinance An FHA Financing So you can A normal Mortgage?

Altering of a keen FHA loan so you can a normal loan are going to be a sensible circulate when your credit rating has gone up and you have accumulated equity of your house. Of the refinancing to help you a normal financing, you may be capable reduce the size of your loan, take pleasure in all the way down interest levels, and relieve your own monthly obligations.

Why you should Re-finance Regarding A keen FHA So you’re able to A traditional Financing?

FHA loans are often a better option for of a lot very first-day homeowners because they provides more regulations than just old-fashioned lenders. These types of funds, supported by the federal government, often have much easier standards, particularly lower payday loan Akron credit scores, because the FHA insures them.

Although FHA loans will likely be more straightforward to score, lots of property owners want to button thereby applying to have an excellent antique mortgage later. This could be to get rid of using mortgage insurance coverage and you will lower its monthly obligations or would a cash-away home mortgage refinance loan regarding the collateral in their home.

Requirements So you can Refinance Of A keen FHA Financing To help you Old-fashioned

Refinancing of a keen FHA mortgage so you can a conventional loan is also open upwards new possibilities, however it need appointment particular criteria. Here is what you should know to begin:

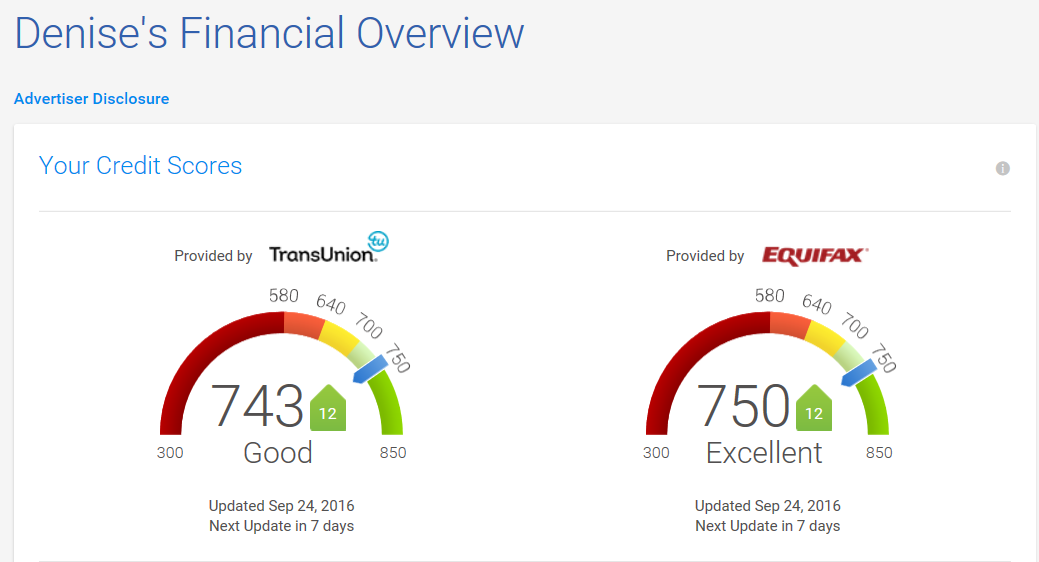

- 620 minimum credit score: First, look at your credit rating. You will need at least 620 so you’re able to qualify for a normal mortgage. Remember, increased credit history could lead to most readily useful conditions once you refinance.

- Debt-to-Money Proportion (DTI) out-of 50% otherwise shorter: That it proportion measures up their month-to-month personal debt repayments into the monthly disgusting income. Your DTI are going to be 50% otherwise down. The low their DTI, the higher the terms you can found.

- 3% 5% house guarantee: Building family equity is vital, hence goes since your house’s really worth increases so when your lower the home loan. You need at the least 3% 5% collateral.

- Proof of residence’s worthy of: After you refinance, you’ll likely you need a different assessment. It will help loan providers find out if your property has enough value so you can secure the guarantee needs.

- Not any other the liens: Make certain that there are no most other liens at your residence, such delinquent taxes or any other debts. If there’s an extra mortgage, one to financial need to commit to condition the mortgage trailing the fresh new mortgage.

Conference this type of criteria is a significant action to your changing your own FHA mortgage toward a traditional mortgage and perhaps rescuing on the month-to-month homeloan payment through getting reduce home loan insurance coverage.

Pros Out of Refinancing Off FHA To help you Traditional Mortgage

Refinancing can result in significant monetary gurus from the potentially removing FHA home loan insurance premiums (MIP) getting home owners who possess oriented sufficient security. Additionally, refinancing you are going to give you the advantage of lower rates of interest, causing all the way down mortgage payments.

Shed Your own Financial Insurance premium (MIP)

When securing an enthusiastic FHA loan, borrowers are required to spend FHA Mortgage Insurance fees (MIP), whatever the down-payment count. This consists of an upfront MIP at closing and you will a yearly commission split all over month-to-month mortgage repayments.

- A down-payment of ten% or maybe more causes MIP money to own eleven years.