It needs extended to get the right family for your, also it means several excursions regarding urban area to gain access to individuals communities and you may apartments. If you are looking to purchase a house with a home loan, you’ll have to undergo a different bullet of meetings on the financial, that may encompass several layers out-of papers and you can records. Henceforth, Home First Monetary institution has introduced digital solutions home loan category so you’re able to express the whole process of making an application for a great financing.

Home Earliest Monetary institution designs Show Fund to really make the loan process quick and you will simple. You can make an application for home financing on line within at any time and regarding one place.

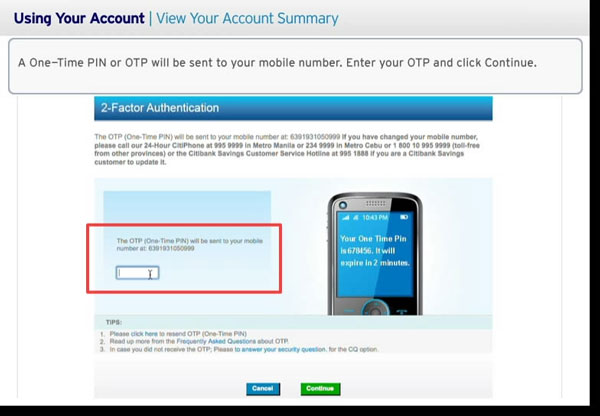

After you fill in the application on line, you’ll found punctual approval. HomeFirst enables you to receive a loan sanction in just 5 points. This service membership offers a primary Sanction Page, on what you might obtain financing.

Step one: Be sure your bank account | Step 2: Explore your income details | Step 3: Explain your property details | Step four: Provide their email address | Step 5: Get financing bring

Features of HomeFirst Home loan

- It can be accepted in just several clicks.

- Right now regarding mortgage acceptance, no documents are required.

- Most readily useful corporates will enjoy a different sort of processing contract.

- Your order is actually paperless, as well as the whole home application for the loan process is performed online.

Qualifications for Mortgage

Credit score/Credit history: Generally, loan providers love to give to people having fico scores regarding 750 or a lot more than. Like mortgage people has actually a far greater possibility of providing home loans with just minimal rates.

Period of the Applicant: Essentially, the lowest age to apply for home financing are 18 decades, and limitation ages during the time of financing readiness is actually 70 many years. The fresh new payback time is normally doing thirty years, with many lenders capping age senior years due to the fact maximum many years limit.

Income and you may a career: A leading money americash loans Chester Center means an elevated capacity to pay-off that loan, implying a lower exposure to the bank. Due to their higher-income predictability, salaried professionals routinely have a far greater threat of obtaining house loans at the down rates.

Installment Capacity: Banking institutions and you may HFCs often accept mortgage loans to candidates whose entire EMI relationship, such as the recommended home loan, will not exceed 50% of their complete earnings. Once the opting for a longer loan period reduces the home mortgage EMI, persons which have reduced financing qualifications can be finest their condition by going for an extended period.

Property: Whenever choosing house financing qualifications, lenders consider the property’s shape, strengthening services, and you may ount which are provided into the possessions. The maximum amount a lender can offer towards a casing financing do not go beyond 90 percent of your property’s well worth, according to RBI direction.

Records Required

To find a home loan, an applicant should provide numerous documents installing its KYC, the brand new antecedents of the house they attempt to buy, the earnings record, and the like, according to which customers class they get into (salaried/professional/businessman/NRI).

Brand new papers required differs from one to lender to another. Allow me to share a few of the most typical data necessary for a home loan for the India.

Simple tips to Pertain?

In advance in search of your dream family, you will have a sense of exactly how much from property mortgage would certainly be qualified to receive predicated on your income. It can help you in and work out a monetary view regarding your domestic you may like to and obtain. You are able to the mortgage eligibility calculator to choose exactly how much currency you are entitled to. Once the assets has been accomplished, you may want to go to the HomeFirst web site and fill out the fresh inquiry setting to find a call straight back from just one of our own Counsellors. Look for this short article for additional information on financing terminology, or this information to know about brand new files necessary for financing software.

To the significantly more than pointers at your fingertips, it’s possible to clearly answer the trouble out-of how much cash family financing you can to get considering their earnings and take an enormous step to your purchasing the fantasy domestic.