Qualifications criteria

The federal government offers a different option to the staff to save for senior years than just individual people. The brand new Thrift Offers Plan (TSP) is quite just like common preparations found in the personal sector, enabling pre-income tax efforts, employer suits, and enough time-label earning potential in a variety of fund. But it has many novel choice which can create an enthusiastic attractive benefit to own signing to a national work.

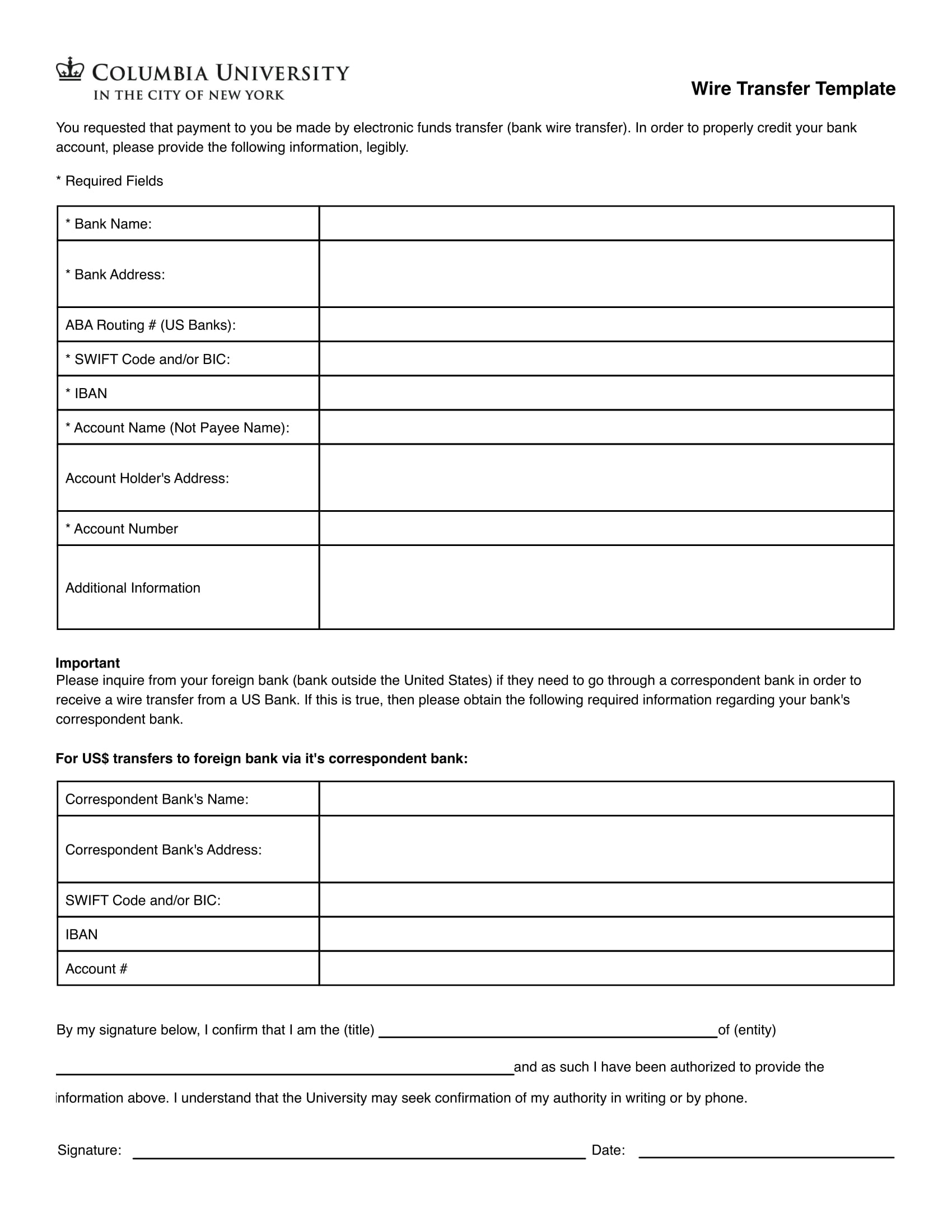

Thrift Savings Plan finance have a list of qualification qualifications, bear focus costs, and you can an administrative percentage away from $50 that is deducted regarding full amount borrowed.

Loan restrictions and you may words

Thrift Offers Agreements is defined share arrangements that enable you to allocate a fraction of the pre-tax spend to help you a financial investment funds, constantly courtesy payroll write-offs. Your boss may decide to sign up to your account, increasing the total number that’s available to own investment.

To have 2024, you might lead as much as $23,000 in order to both antique or Roth Teaspoon solutions while you are young than simply years fifty. If you are older or have a tendency to change 50 this present year, you are able to a supplementary $eight,five-hundred in the catch-up contributions.

Quick suggestion: You could import tax-deferred funds from private senior years preparations (IRAs) and other types of boss-paid agreements into a classic Tsp. For those who have an excellent Roth Tsp, you could add certified and low-licensed balance from other types of Roth membership.

Brand new yearly maximum for further benefits to have 2024 was $69,000. These are generally staff contributions that are taxation-deferred, after-income tax, and you will income tax-exempt, in addition to matching and you may automatic step one% benefits out of your agency or branch of provider. Catch-upwards efforts commonly measured in this restriction.

https://simplycashadvance.net/loans/payday-loans-with-savings-account/

You might not shell out fees towards the benefits otherwise money for the a antique Tsp if you don’t begin taking distributions, that can start when you change 59 ?. And you will withdrawals was taxed as the normal money. But not, you may roll-over withdrawals for the yet another senior years membership and extra delay the income tax accountability.

If you opt to put the money into the a good Roth IRA, you can afford the income taxes on shipping today. When you take distributions in the Roth IRA, they’ll certainly be income tax-100 % free. Thrift Savings Plan distributions are required once you turn 72.

Which have Roth TSPs, that you do not spend fees for the money you directly contributed to the master plan. You additionally cannot shell out taxation on money attained when while making a qualified delivery. To own a shipment as noticed qualified, you have to be at the least 59 ? and also at least five years need to have introduced since your very first Roth sum was developed.

Advantages and disadvantages

There are a lot of positive points to participating in good Thrift Deals Package, plus building a strong senior years finance courtesy a variety of varied financial investments. As with one resource device, there are even disadvantages you really need to envision. Let me reveal a look at a number of the advantages and disadvantages out-of Teaspoon arrangements:

Impact on senior years deals

Thrift Savings Agreements render participants a few choices for paying their cash. Lifestyle fund was a combination of 10 loans one buy stocks, ties, and government ties. This is made to generate purchasing simple for people who has a long time before advancing years or are not knowledgeable about handling financing.

“Lifecycle funds are a good varied mix of the income which you normally spend money on,” claims Shawn Plummer, Chief executive officer of one’s Annuity Specialist. “The funds try designated instantly according to your actual age additionally the date you intend in order to retire. If you find yourself more youthful, the fresh new assets might be so much more competitive, nevertheless allocations perform gradually become more old-fashioned since you near your retirement ages.”